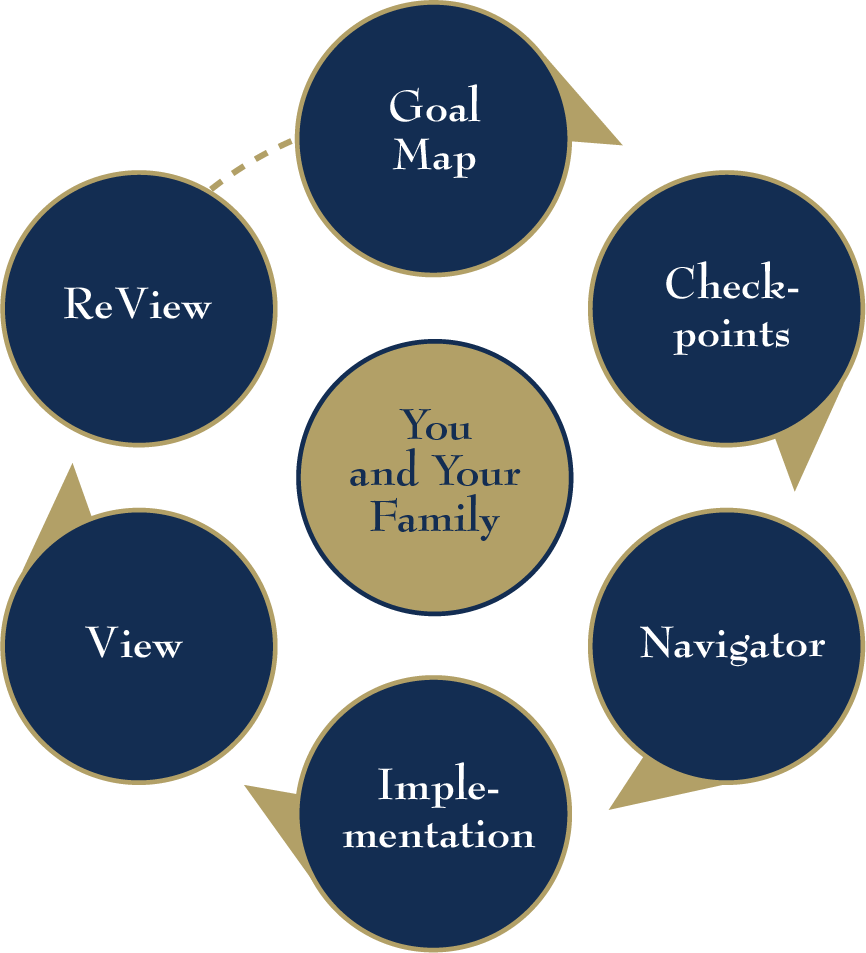

With your interest in mind, our knowledgeable team helps you achieve financial success using creative solutions. That success is measured by whatever you set as your personal goals! Our six-step PathWise™ process is one of the ‘best in class’ systems that guides you through a complete Comprehensive Financial Plan tailored to your goals and desired outcomes.

The Goal Map Meeting

This introductory meeting sets the stage for what you wish to accomplish. Your goals will be the foundation for all we recommend throughout the process.

If you decide that B&E will be a good fit for you, we would both sign the Planning Agreement.

Financial Checkpoints Meeting

We sometimes refer to the Checkpoints meeting as the “As-Is” because this shows us what your setting would look like if you do nothing different than what you are currently doing.

We would gather various, pertinent information.

We analyze all of this and present you with our observations in a written report detailing our findings for about 10 key areas of your financial lives. During the meeting, we ask a lot of questions to be sure we’ve captured all data accurately and have made reasonable future assumptions.

Navigator Meeting

The Navigator meeting is where B&E will provide written recommendations for any changes that we feel might enhance your setting and better position you to achieve your goals. We also provide you with new financial projections so you can easily see the impact of these recommendations.

As a standard part of our process, each recommendation will disclose our full fees and commissions. Our goal is to never have a client surprised by how we are paid, or by how much we get paid.

At the close of this meeting, you will be given a checklist with details of the strategies recommended to you. You will review and return to B&E when complete, selecting “yes” to those items that you wish to implement and “no” to any that you do not.

Implementation

In the Implementation stage, we will prepare the necessary paperwork for any strategies you have selected from the Navigator checklist.

When any new account or policy is established, B&E will provide you with a letter and the accompanying paperwork for your files. This letter provides you with a brief summary of the account, funding, beneficiaries and other pertinent details like online access instructions.

The View Letter

After all items on the checklist are complete, we will provide a written summary of what we did and why in each area of your financial life. We will also provide you with final projections based only on the recommendations that were implemented. These projections serve as our baseline and benchmark for future meetings.

At this time, you will be given online access to your personal financial plan via our dynamic software. You can access at any time you desire.

The ReView Meeting

The ReView meeting is an annual check against your goals where you are, relative to where we thought you would be, from the baseline projections. We believe this is an essential step in the planning process to make sure things stay on track.

Prior to the ReView, we will update your Balance Sheet and Income Statement with the facts that we know and ask you to update any remaining items. We may request current statements for any accounts that we do not manage via our secure Vault program. This allows us to analyze any new information since we last met.

We will discuss your current setting and update any items necessary to ensure your projections are reflecting an accurate forecast. These may include items such as job changes, retirement plan changes, stock options, insurance coverage, new family members or new goals.